Loan Scams and Fraud: Your Guide to Protect Your Money

- Guides

Desperation can make us vulnerable. When faced with financial strain, the allure of a quick and easy loan can be difficult to resist. Unfortunately, scammers prey on this vulnerability, weaving a web of deceit that can leave individuals trapped in a cycle of debt and despair. Loan scams have become a pervasive threat, lurking in the shadows of the financial world, ready to pounce on unsuspecting victims.

These fraudulent schemes come in various forms, each designed to exploit the hopes and dreams of those seeking financial assistance. The consequences of falling victim to a loan scam can be devastating, leaving individuals with shattered finances and tarnished credit histories.

But knowledge is power. By understanding the tactics employed by these unscrupulous individuals and arming yourself with the tools to identify their deceptive practices, you can protect yourself from their clutches. This guide will serve as your shield, providing you with the insights and strategies necessary to navigate the treacherous waters of loan scams. Together, we will uncover the truth behind these scams, empowering you to make informed decisions and safeguard your financial future.

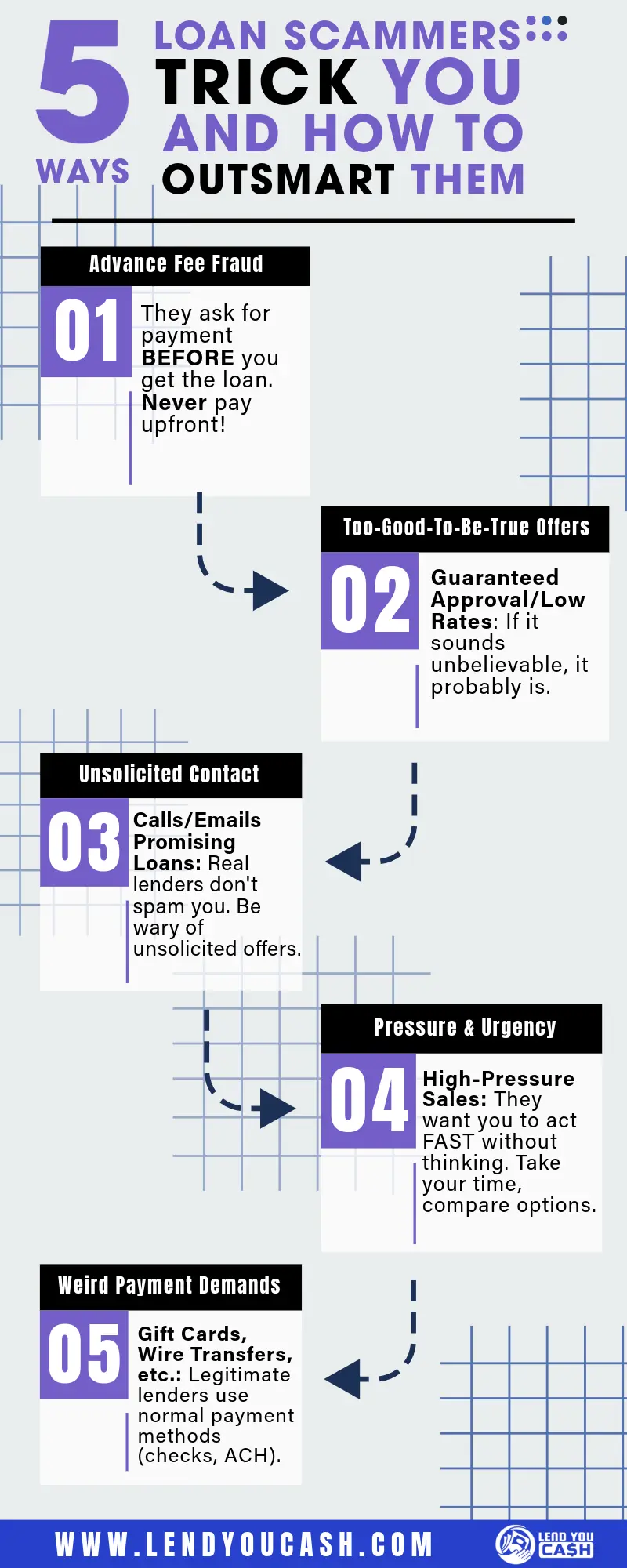

Common Loan Scams and Fraud: Recognizing the Red Flags

Loan scammers are masters of disguise, adept at crafting convincing narratives and promises that can easily lure unsuspecting borrowers into their traps. However, beneath the veneer of legitimacy lie telltale signs that can help you distinguish a genuine offer from a fraudulent scheme. By familiarizing yourself with these red flags, you can sharpen your discernment and protect yourself from falling victim to these predatory practices.

- Advance Fee Fraud: One of the most prevalent loan scams involves the demand for upfront payment. Scammers may request an advance fee, often disguised as an application or processing fee, promising to deliver a loan once the payment is made. However, once the money changes hands, the scammer disappears, leaving the victim empty-handed. Remember, legitimate lenders rarely require payment before disbursing a loan.

- Unsolicited Loan Offers: Beware of unsolicited loan offers that arrive via phone calls, emails, or text messages. Reputable lenders typically do not resort to aggressive solicitation tactics. If you receive an unexpected offer that seems too good to be true, it probably is. Always verify the lender’s credentials and reputation before proceeding.

- Guaranteed Approval: No legitimate lender can guarantee loan approval without thoroughly assessing your financial situation. If a lender promises guaranteed approval regardless of your credit history or income, it’s a major red flag. Legitimate lenders follow strict underwriting guidelines to determine eligibility.

- High-Pressure Tactics: Scammers often employ high-pressure tactics to coerce borrowers into making hasty decisions. They may create a sense of urgency, claiming that the offer is limited or that rates will increase soon. Don’t succumb to pressure; take your time to research and compare offers from different lenders before committing.

- Request for Unusual Payment Methods: Be wary of lenders who insist on unconventional payment methods, such as gift cards, wire transfers, or cryptocurrency. These methods are often favored by scammers because they are difficult to trace and recover. Legitimate lenders typically accept payments through secure channels like checks or electronic transfers.

Keep your eyes peeled for these warning signs, and you’ll be much less likely to get tricked by loan scams. If a deal sounds too good to be real, it probably is. Always trust your gut and do what you need to do to keep your money safe.

Common Loan Scams Infographic

Hover to scroll or Click to Enlarge

Verifying the Legitimacy of a Lender

Before entrusting your financial information or making any payments, it’s imperative to verify the legitimacy of a lender. This step can mean the difference between securing a legitimate loan and falling victim to a scam. Here are some essential steps to take:

- Check for Licenses and Registration: Legitimate lenders are required to be licensed and registered with relevant state and federal authorities. You can verify a lender’s credentials through official sources such as the Nationwide Multistate Licensing System & Registry (NMLS) Consumer Access database. This database allows you to search for lenders by name or unique identification number and confirm their licensing status.

- Research Online Reviews and Reputation: In the digital age, information is readily available at our fingertips. Take advantage of this by conducting thorough research on the lender’s online presence. Look for reviews and ratings from other borrowers on reputable platforms. Be wary of lenders with consistently negative feedback or a lack of online presence.

- Contact Regulatory Agencies: If you have doubts about a lender’s legitimacy, don’t hesitate to contact regulatory agencies. The Consumer Financial Protection Bureau (CFPB) and your state’s Attorney General’s office can provide valuable information and resources to help you verify a lender’s credentials and report any suspicious activity.

Do your homework and check things out—it’s the best way to avoid those shady loan scams. Real lenders are upfront about their credentials, have solid online reviews, and won’t hesitate to answer your questions. Trust your instincts. If something feels off, don’t be afraid to walk away and find a lender you can trust.

Protecting Your Personal Information

Loan scammers often rely on obtaining your personal information to carry out their fraudulent schemes. By safeguarding this sensitive data, you can significantly reduce your vulnerability to these scams. Here are essential tips to protect yourself:

- Be Cautious with Sharing Sensitive Data: Never share your Social Security number, bank account details, credit card information, or other personally identifiable information (PII) with anyone you haven’t verified as a legitimate lender. Legitimate lenders will typically request this information through secure channels and only after establishing a formal relationship.

- Beware of Phishing Emails and Websites: Scammers often use phishing emails and websites that mimic legitimate financial institutions to trick you into revealing your personal information. Be wary of emails or websites with suspicious URLs, grammatical errors, or requests for urgent action. Always verify the authenticity of a website or email before entering any personal information.

- Use Strong Passwords and Security Measures: Create strong, unique passwords for your online accounts, including those associated with financial institutions and loan applications. Avoid using easily guessable information like your birthdate or pet’s name. Consider using a password manager to securely store and manage your passwords. Additionally, enable two-factor authentication whenever possible to add an extra layer of security to your accounts.

Think of these tips as your security system against those sneaky loan scammers. Your personal info is like gold, and you need to guard it to keep your money safe.

Reporting Suspicious Activity

Reporting suspicious activity plays a crucial role in disrupting loan scams and protecting others from falling victim. By reporting your experience, you contribute to a collective effort to identify and shut down fraudulent operations. Here’s how you can report suspicious activity:

- Contact the Federal Trade Commission (FTC): The FTC is the primary agency responsible for collecting complaints about loan scams and other fraudulent activities. You can file a complaint online through their website or by calling their toll-free hotline. Provide as much detail as possible about the scam, including the lender’s name, contact information, and the specifics of your interaction.

- Notify Your State Attorney General’s Office: Your state attorney general’s office also plays a vital role in investigating and prosecuting loan scams. Contact their consumer protection division to report the scam and provide them with any relevant information you have gathered.

- Alert Your Bank or Credit Union: If you suspect that your financial information has been compromised or that unauthorized transactions have occurred, immediately notify your bank or credit union. They can help you secure your accounts, dispute fraudulent charges, and take steps to protect your identity.

Reporting suspicious activity isn’t just about you – it’s about looking out for your fellow citizens. By sharing your experience, you can warn others about these scams and help them avoid the same pitfalls. Together, we can make a real difference in stopping loan fraud and creating a safer financial environment for everyone.

Conclusion: Your Financial Future is Worth Protecting

In the world of loans, where dreams of financial stability intersect with the harsh realities of scams, knowledge truly is your most powerful weapon. By understanding the tactics employed by loan scammers, recognizing the red flags, and taking proactive measures to verify the legitimacy of lenders, you can safeguard yourself against these predatory practices.

Your financial well-being is more than just a bank account balance. It’s the foundation of your security, your ability to pursue your goals, and the peace of mind that comes with knowing you’re prepared for the future. By staying informed and vigilant, you can navigate the lending landscape with confidence, making sure your financial decisions are built on a strong base of knowledge and trustworthy information.

If you come across any suspicious activity or suspect that you have been targeted by a loan scam, don’t hesitate to report it to the appropriate authorities. Your actions can not only protect yourself but also help others avoid falling victim to these fraudulent schemes. By working together, we can create a safer and more transparent financial environment for everyone.

Don’t let loan scammers steal your financial future. Empower yourself with knowledge, listen to your gut, and take charge of your money. By learning the ropes and taking precautions, you can get the loans you need without falling into a scammer’s trap.

Additional Resources:

- Federal Trade Commission (FTC): https://www.ftc.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

Frequently Asked Questions

1. What are the most common types of loan scams?

Some of the most common loan scams include advance fee fraud, unsolicited loan offers, guaranteed approval scams, high-pressure tactics, and requests for unusual payment methods.

2. How can I verify if a lender is legitimate?

You can verify a lender’s legitimacy by checking their licensing and registration status through the NMLS Consumer Access database, researching their online reviews and reputation, and contacting regulatory agencies like the Consumer Financial Protection Bureau (CFPB).

3. What should I do if I think I've been targeted by a loan scam?

If you suspect you’ve been targeted by a loan scam, report it immediately to the Federal Trade Commission (FTC), your state attorney general’s office, and your bank or credit union.

4. Are online lenders safe?

Online lenders can be safe if they are reputable and licensed. However, it’s crucial to research and verify their credentials before sharing any personal or financial information.

5. How can I protect myself from loan scams?

You can protect yourself from loan scams by being cautious with sharing personal information, avoiding unsolicited loan offers, verifying the lender’s legitimacy, and reporting any suspicious activity to the authorities.

Loan Scams and Fraud Stories

Story #1

The Inheritance Windfall

Rachel’s phone buzzed with a text message. “Congratulations!” it read, “You’ve been pre-approved for a loan up to $50,000! Reply YES to claim your funds.” With bills piling up and an unexpected car repair, the timing seemed perfect. A quick internet search revealed nothing alarming about the lender, “FastLane Funding,” and Rachel, blinded by desperation, replied “YES.”

Within hours, a representative named Tony called, his voice oozing confidence. He reassured Rachel that her approval was guaranteed and that the funds would be deposited the next day, after a small “processing fee” of $500. Eagerly, Rachel wired the money, her hopes soaring.

But the next day, there was no deposit. When Rachel called FastLane, Tony had vanished, leaving a disconnected number. She realized, with a sinking heart, that she’d fallen prey to a scam. The inheritance she’d counted on had evaporated, replaced by a bitter lesson about the dangers of impulsive decisions.

Story #2

The Unassuming Phish

David, a meticulous retiree, received an email from his bank, warning of suspicious activity on his account. A link was provided to verify his information. David, a cautious man, was immediately suspicious. The email address was slightly off, and the link, when hovered over, led to a strange URL.

He logged into his bank account directly, not through the email, and saw no suspicious activity. David promptly reported the phishing attempt to his bank and the Federal Trade Commission. He knew that even the most vigilant could fall victim to scams, but he was determined to stay one step ahead.

Story #3:

The Bait-and-Switch

Ava, a young entrepreneur, needed capital for her start-up. She’d been turned down by traditional banks due to her limited credit history. Then, she stumbled upon an online lender offering loans with no credit checks and low interest rates. It seemed like the answer to her prayers.

After submitting her application and providing her personal information, Ava received an approval notification. However, the terms were vastly different from what was advertised. The interest rate was exorbitant, and the repayment schedule was predatory.

Ava, realizing she was on the brink of a scam, declined the offer. She turned to a local credit union, where she found a more transparent and affordable loan option. The experience taught her the importance of thorough research and skepticism when dealing with online lenders.

LendYouCash is a Licensed Online Direct Lender for Personal Loans In Texas

Get an Personal Loan to cover your Unexpected Expenses.

You can get up to $1,000 as soon as the next business day.